By Laura Suleimenova

Falling oil prices, as well as sharp deterioration in relations between

Falling oil prices, as well as sharp deterioration in relations between "ONE BILLION- AND NOT A CENT LESS!"

According to updated estimate and schedule of works presented by Tengizchevroil to its shareholders in November of last year, the costs of TCO's projects titled “Wellhead Pressure Management/ Future Growth Project" (WPM/FGP) doubled in cost and the terms of its implementation were postponed for two years.

So, if in April, 2014 its cost was $23,7 billion, in November of the same year it reached $38,8 billion. In particular, the cost of FGP facilities increased from $11 billion to $14 billion, WPM facilities - from $10,4 billion to $22,4 billion. The commissioning dates of FGP are postponed from 2019 to 2021.

It is clear, that the

During his last visit to Atyrau the RoK Minister of Energy Vladimir Shkolnik said that currently the work is ongoing on optimization of FGP towards reduction of its cost.

However the

Earlier KMG suggested TCO to use borrowed funds ($8-11 billion) as a financing source and even signed the Memorandum, where the amount of loan, sources of means and financing terms were defined.

TCO plans to make a final decision on financing until the end of 2015.

TCO LOOKS FOR WAYS TO BY-PASS

In case the relations between the West and

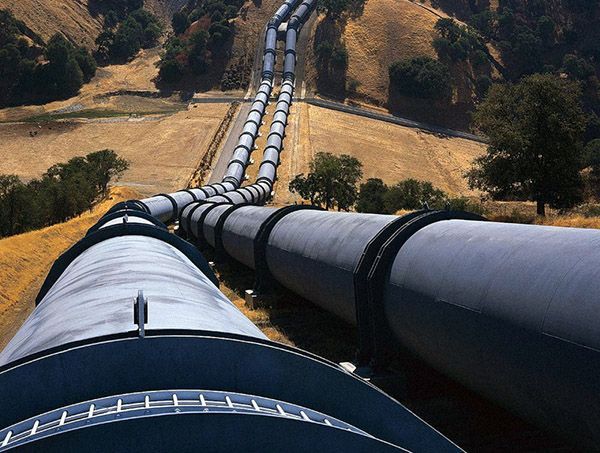

The main route of transportation of Tengiz oil is CPC oil pipeline that goes through

In November of last year in his interview to the Kazakhstan newspaper “Panorama", TCO's CEO Tim Miller informed that they have a team that doing research of the issue of possible consequences for TCO's activity of the anti-Russian sanctions.

"They studied how it may end and what we should do in such situations. Presently, this team is continuing its work. They do monitoring. And, respectively, they develop alternative decisions aimed at mitigation of possible consequences of such sanctions. And we have already took some of the mitigation measures that the team proposed in relation to transportation of the liquefied petroleum gas. We changed the transportation route of this product that helped us to avoid consequences from sanctions. Of course, it will be good for us if we have alternative directions", - said Miller.

To the journalist's question, whether TCO considers as an alternative the Chinese direction (after "KazTransOil" will complete the reverse of Atyrau - Kenkiyak oil pipeline), Miller answered: -"Yes. We pay attention to the safety of this route, its reliability and commercial side. And we continue to consider all possible routes".

In 2013 TCO resumed transportation of oil via, so-called, Southern route – Baku- Tbilisi- Ceyhan pipeline (BTD), that was interrupted in 2008 because of high tariffs for transfer.

Along the Southern route the Tengiz oil is exported from

TCO chartered the Aktau tanker belonging to Kazmortransflot for transportation of oil from Aktau to

It is interesting to know that on February 23 of this year on Chevron's website there was information about completion of railway system upgrade at Tengiz as per the requirements of railway transportations of the

According to information, total length of railway is

If at the beginning of Tengiz field development the rail cars park contained six locomotives that have already served their terms and needing major repair, then today there are 30 locomotoves. Since 1995 TCO shipped via railway 492,2 million barrels of oil.

It is remarkable that the railway together with CPC, is positioned by the company as the main means of transportation of oil that unlike pipelines, allows to support deliveries of different types of raw materials, despite weather conditions, planned and unplanned repairs.

According to AkZhaik information, the long discussed issue of construction of Karachaganak gas processing plant and main gas pipeline "Aksai - "Bukhara-Ural" isn't resolved until today. These projects are connected with each other, since they make the basis for the 3rd phase of expansion of the largest oil-gas condensate Karachaganak field that is scheduled for commencement in 2017.

Although, the plant design engineering and state expertise's conclusion were ready in

To recall, the transportation system "Kacharaganak –

Shareholders of KPO are "BG Group" (29,25%), "Eni" (29,25%), "Chevron" (18%) and "Lukoil" (13,5%). Since July 1, 2012 the Kazakhstan KMG company entered the consortium with its 10 % shares.

However the latest information from our sources are encouraging. Between KMG and Gazprom the difficult negotiations are ongoing. The consent on the main issue of extension of the purchase and sale contract has been reached, and further negotiations on final conditions are still under discussion.

В Атырау -10

В Атырау -10