ConocoPhillips announced on Monday that it has intention to sell its 8.4% in the North Caspian Production Sharing Agreement to ONGC Videsh Limited. The proceeds from sale would be $5bn, reads the company press release. The deal is slated to close in the 1H 2013.

ConocoPhillips announced on Monday that it has intention to sell its 8.4% in the North Caspian Production Sharing Agreement to ONGC Videsh Limited. The proceeds from sale would be $5bn, reads the company press release. The deal is slated to close in the 1H 2013.

BIGGEST FOREIGN BUYOUT

ONGC Videsh (OVL), the international branch of the Indian state-run energy giant ONGC (Oil and Natural Gas Corp) has interests in projects in more than 12 countries, including a 25% interest in 1,482-sq-km Satpayev exploration block in the Caspian Sea acquired from NC KazMunayGas in 2011.

The purchase of the stake from ConocoPhillips (COP), still subject to various government and corporate approvals, would mark the biggest-ever foreign acquisition by ONGC and surpass the value of its $2.2bn buyout of Russia-focused Imperial Energy in 2009.

SHEDDING NON-CORE OVERSEAS ASSETS

Texas-based ConocoPhillips said early in 2012 it was aiming to sell non-core assets as part of a restructuring drive while fuel-import dependent India has been scouring the globe to lock in fuel supplies for its expanding economy.

“The sale of this quality asset is an important component of our ongoing strategic asset disposition program,” said Don Wallette, a senior ConocoPhillips executive, in a statement.

“We are pleased that ONGC Videsh recognises the value of this asset,” he said.

COP, which has been shedding non-core overseas assets to reduce debt and swell its exploration budget, said its disposal drive has yielded $2.1bn so far. The sale of the Kashagan field would push that sum to $7bn “and strongly position the company to accomplish its target of $8-$10bn by the end of 2013,” ConocoPhillips said.

Meanwhile, ConocoPhillips still has a 25% stake in a joint venture to develop the N Block also in the Caspian Sea, which it entered in 2009.

MOST EXPENSIVE DISCOVERY

OVL said in a statement late on Monday: “The acquisition would mark OVL’s entry into the largest oil proven North Caspian Sea of Kazakhstan.”

OVL will be taking on a tough challenge in buying a stake in the project that has been dogged by spiralling costs and extensive delays. Start-up of the field has been delayed since 2005 due to cost overruns and disputes with authorities over taxes.

It is tagged by CNNMoney as the most expensive discoveries of the last 40 years and its development has already absorbed $116bn. First production is expected in 2013.

2 MONTHS TO PRE-EMPT

2 MONTHS TO PRE-EMPT

The existing partners of Kashagan oil project - national oil company KazMunayGas, Eni (Italy), ExxonMobil (USA), Inpex Corp( Japan), Dutch Shell and France’s Total have 60 days to decide whether they want 8.4% stake in the project promised to India’s Oil and Natural Gas Corp.

ONGC Videsh Managing Director D.K. Sarraf told Reuters, Kazakhstan’s government has 6 months to approve the deal after the expiry of a 60-day period for partners to exercise their pre-emption rights. “The deal has to be approved within 240 days,” he said.

REVIEW COMMISSION

Kazakhstan has first refusal on the stake, and a commission that reviews major deals could take up to two months to decide whether to buy, as well as consider the energy and economic security issues, Oil and Gas Minister Sauat Mynbayev told reporters on Tuesday.

Last month, Chief Executive Lyazzat Kiinov said the state company would be interested in principle in acquiring the stake. His deputy, Daniyar Berlibayev, said much would depend on the cost.

“We, as a national company, wouldn’t refuse the idea of increasing our share. How we might finance this is another question,” Berlibayev told Reuters on October 2.

KazMunayGas has bought stakes from consortium members in the past, entering in 2005 by purchasing half of BG Group’s 16.7 per cent stake when that was put up for sale. Three years later, it bought another 8.4 per cent from consortium members.

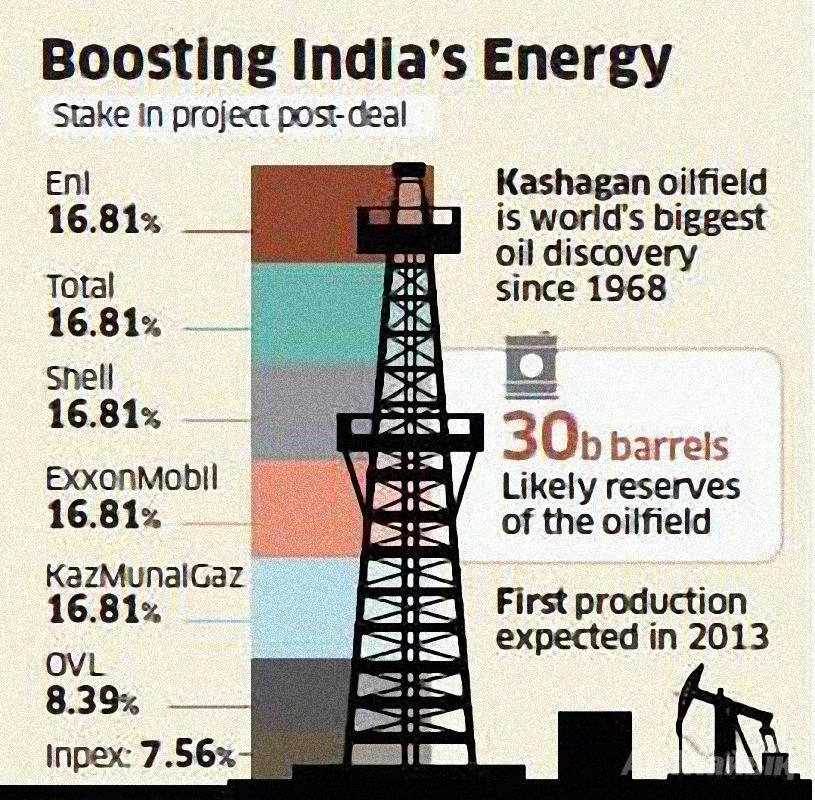

Italy’s Eni, Royal Dutch Shell, France’s Total, ExxonMobil and KazMunayGas have 16.81 percent stakes each while Inpex of Japan holds the remaining 7.56 percent.

Kashagan holds an estimated 30 billion barrels of oil-in-place, of which 8-12 billion are potentially recoverable. The Kashagan field will have an initial capacity of 370,000 barrels a day.

by Zeena Urynbassarova

November 30 2012, 11:36

В Атырау -10

В Атырау -10